My favorite venture capital datapoint just dropped: Time spent reviewing pitch decks from startups.

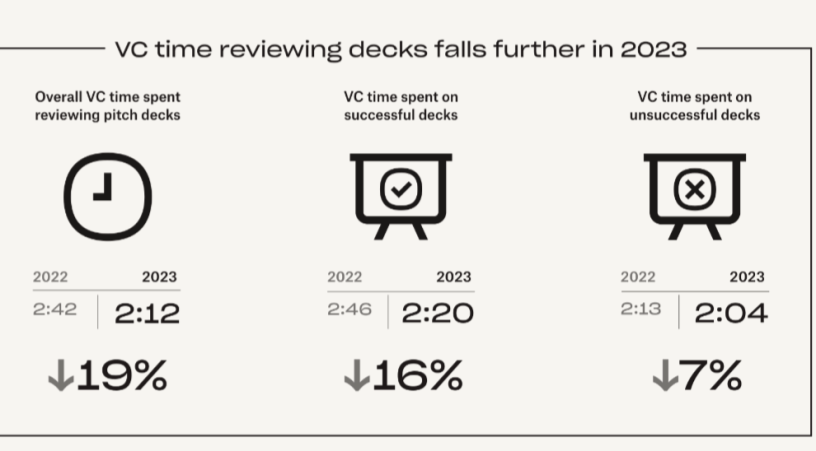

The answer is just 2 minutes and 12 seconds on average.

It’s down 19 percent from 2 minutes and 42 seconds last year.

It’s amazing when you think of how much effort, how many hopes and dreams, can get compressed into such a short amount of time.

For perspective: it’s about the same amount of time the American Dental Association recommends you take to brush your teeth.

The stat comes from a report generated by DropBox DocSend, which gathers the data in the course of managing the distribution of pitch decks from startups to potential investors.

The number is a great example of alternative data, illustrating how a third-party service can capture wider insights about an industry that participants wouldn’t disclose.

The number suggests that everything is speeding up, of course. We live in a TikTok world.

But I’m not sure what it says about the state of the VC market, which has been in a slump since interest rates started rising a year ago.

It could mean VCs are more selective and less willing to take time to review new deals.

Or, since pitch decks are aimed at landing meetings, it could mean that startups are getting better at making decks that can be analyzed quickly.

VCs with years of experience can presumably evaluate companies faster and faster.

As you might expect, VCs spend less time evaluating decks they don’t fund (2 minutes and 4 seconds) versus successfully funded companies. (2 minutes and 20 seconds.)

A whole cottage industry has developed around helping founders secure funding.

Kat Weaver is one person worth following on LinkedIn. She founded Power to Pitch to advise founders on how to create better decks and fundraising strategies.

Part of Weaver’s pitch is that you can’t rely on just the pitch.

That means doing more to raise your visibility before you even promote your business.

She notes on her LinkedIn page: “When it comes to raising capital, you have to start with your story and treat the investor relationship like a marriage.”