The fintech migration to Miami just marked its official third anniversary.

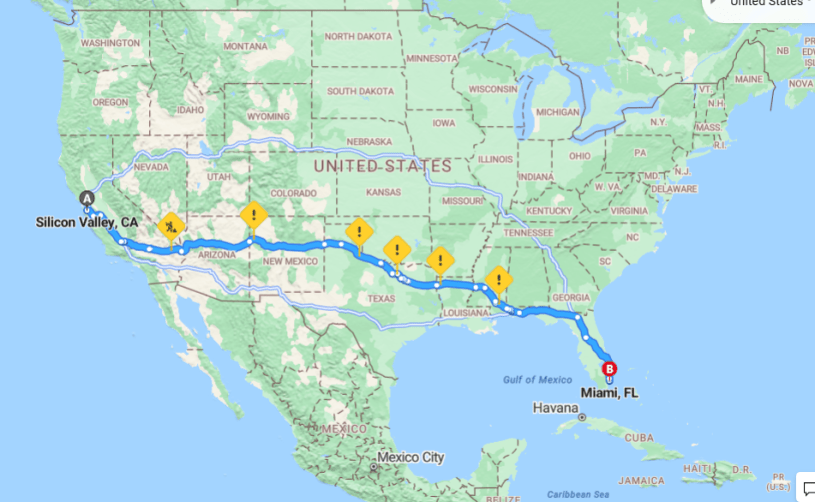

On Dec. 4, 2020, during the midst of the pandemic, Silicon Valley VC Delian Asparouhov tweeted: “ok guys hear me out, what if we move silicon valley to Miami?”

Miami Mayor Francis Suarez tweeted a response: “How can I help?”

Since then, Delian has moved to Florida joined by scores of prominent CEOs and investors from Jeff Bezos to Keith Rabois.

There has been no shortage of media documenting the phenomenon.

My favorite source, however, isn’t the mainstream media, but a newsletter by Eric Rosen, a former JPMorgan credit trader who moved to the state in 2017.

The Rosen Report covers the investment and political scene in general, but Eric comes at it from a South Florida point of view. He provides color that is often left out elsewhere.

I appreciate how he marshalls details that resonate. A recent issue of the Rosen Report laid out the metrics that capture the influx of affluent fintech people: condo prices, golf course memberships and Michelin star restaurants.

Here he is on real estate:

In Miami, multiple new condo developments are getting $5,000/ft+. Just five years ago, $2,000/ft was expensive. At the Shore Club condos in Miami Beach, the average sale is $21mm at almost $6k/foot. Five years ago, a waterfront home in Miami would cost $15mm+ and today, the same home is $35-50mm.

On the R/E front in Boca, when I moved in 2017, one home sold for over $10mm in my community. Today, 31 homes are asking $10mm or more and 10 are asking over $20mm in Royal Palm. Follow the money.

On golf courses:

Shell Bay golf course in Hallandale is now $1.35mm and FULL. When I moved down, $150k was expensive for golf course initiation. A course near me, Boca Rio, was dying for members 7 years ago with zero to $10k initiation. Today, it is $350k with a waitlist. Follow the money.

On the culinary scene:

Florida now has 19 Michelin Star restaurants (up from zero) and 12 are in Miami. Further, Miami has 18 Bib Gourmand designations from Michelin. Other amazing Miami restaurants include Zucca, PortoSole, Contessa, ZZs, Carbone, Milos, LPM, Dirty French, Rao’s (just opened from NYC), Novikov, Zuma, and so many others.

Eric may not be a journalist at a big media outlet, but he follows a classic “assertion and evidence” style of writing. Journalists describe this as “show don’t tell.”

His newsletter includes a raft of other information, including top stories and interesting charts and personal details about his passion for art and food and travel.

He has a more conservative slant than I get reading the New York Times or other media sources, which helps balance my information diet.

At JPMorgan, Eric used to write a daily note that circulated inside the firm. The one day he didn’t publish he got a call from Jamie Dimon asking where it was.

That drove home the point that content can connect people.

The Rosen Report takes him 20 hours to produce. “It’s a terrible ROI,” he says.

But the effort pays off in connections with hedge funds and billionaires. It has landed him speaking engagements and board seats. At dinner, people want his perspective.

The newsletter has also led to opportunities to sell real estate.

On Monday, Eric got his real estate license from Douglas Elliman.

On Tuesday, he showed four homes to a reader of the Rosen Report.