I was reporter covering Wall Street in the early 1990s. Then, as now, earnings were a big deal.

One important data point we tracked was the number of companies that reported better-than-expected earnings.

We compiled that list of “surprises” manually, publishing them in an article clients could cut and paste into Excel.

It took (comparatively) forever to gather and process.

Earnings get even more scrutiny these days. There’s probably more time and money spent predicting corporate earnings than hurricanes. But for all the effort, neither phenomena seems to be getting any easier to forecast.

According to data from Bloomberg Intelligence, analysts were forecasting 7% growth in third-quarter earnings for the S&P 500 as recently as mid-July. That’s been reduced to 4.2% now. Companies meanwhile have provided guidance that profit will growth 16%

That is one of the biggest gaps on record, according to a Bloomberg article quoting Gina Martin Adams, chief equity strategist at Bloomberg Intelligence.

While the ability to accurately predict events continues to elude, what is getting easier is the ability to leverage AI to summarize and analyze what is happening closer to real time.

I asked SigTech’s MAGIC, an Gen AI tool for financial professionals, to break down what’s happened in the past several weeks.

The analysis started by listing the results of major companies that have reported:

–Goldman Sachs: Reported EPS significantly above analysts’ expectations

–Johnson & Johnson: Both GAAP and Adjusted EPS figures exceeded expectations

–Bank of America: Reported figures indicated a beat over expected EPS

–UnitedHealth Group: Reported EPS exceeded analysts’ expected figures

It then provided aggregated numbers for results vs expectations:

–Positive EPS Surprises: 79% of the S&P 500 reported EPS above estimates

–Revenue Surprises: 60% of companies reported positive sales surprises

And then changes in forward looking guidance:

–Negative Guidance: 60 companies issued negative EPS guidance.

–Positive Guidance: 50 companies issued positive EPS guidance.

–Revisions: Six sectors reported lower earnings vs September estimates

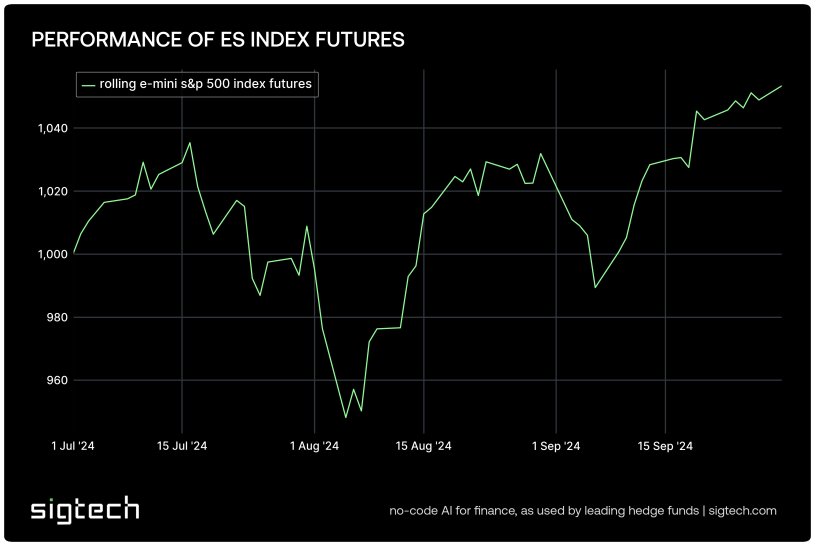

The market has responded positively, with the S&P 500 index gaining 3.23% over the past month and the ES Index Futures also posting solid gains, a sign of a more rosy outlook.

What changed in the landscape? According to MAGIC key factors include:

–Federal Reserve Actions: Rate cuts supported growth, boosting sentiment

–Inflation: Stabilization prompted positive consumer sentiment

–Market Rotation: Shift from tech to value stocks indicated diversification

–Economic Signals: Mixed labor market data provided volatility while maintaining stability

–Geopolitical Conditions: Political uncertainty did not significantly hinder performance

–Sector Shifts: Defensive sectors like healthcare gained traction as stable investments

It’s amazing how fast we get used to this technology and even take it for granted.

One thing is clear, it’s going to change the workflow for analysts who previously spent a tremendous amount of time gathering data. The introduction of AI will shift time toward analysis.

Given the complexity, it remains to be seen how much better they will be at forecasting.