The craziest aspect of the DeepSeek story is how investors and the media reacted.

I don’t mean yesterday, when Nasdaq lost $1 trillion and my feed was flooded with articles.

I mean the previous seven days.

There was little reaction when DeepSeek announced on Jan. 20th in a tweet that it had a new high-performing large language model that cost a fraction of OpenAI’s ChatGPT. Few media outlets covered it and shares of Nvidia and other big tech firms didn’t immediately move.

I can’t think of a precedent for such a large market move coming a week after a corporate announcement.

It’s arguably the biggest dropped ball in memory on the part of financial journalists and money managers.

I drew three quick lessons:

-Twitter matters, again

-Markets are herd animals

-The mainstream media (still) matters

Let’s unpack the sequence:

On Jan. 20th, DeepSeek tweeted it was unveiling a new, open source model. It included a link to the research paper.

A small, but not insignificant number of news outlets covered the story, including: AI News, Analytics India, VentureBeat, Techcrunch, Yahoo! Finance and SiliconAngle.

A larger number of individual influencers on social media quickly retweeted the DeepSeek post, including Louie Peters, Paul Riolo and, my friend, Alex Banks.

Debates ensued on X, and blogs like Stratechery and even at Davos.

By Wednesday, Jan. 22nd, however, people had tried the model and a consensus had emerged that it was the real deal.

Bloomberg podcaster Joe Weisenthal was the first person I saw frame the issue for investors.

He tweeted: “I’m going to ask what is probably a stupid question but if deepseek is as performant as it claims to be, and built on a fraction of the budget as competitors, does anyone change how they are valuing AI companies? Or the makers of AI related infrastructure.”

Joe is a singular figure in financial journalism in that he works for a large, established brand while still having both feet firmly in social media.

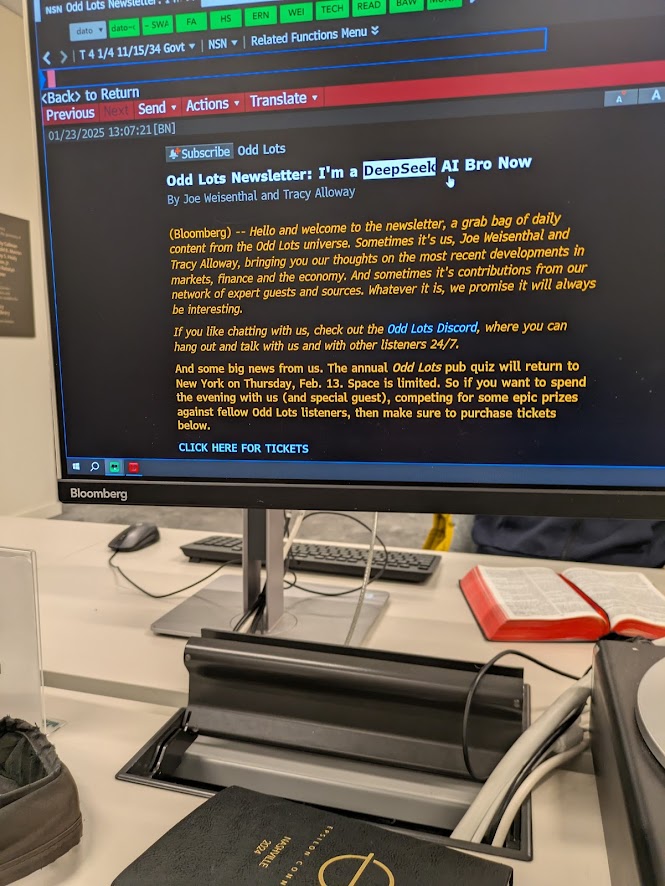

That afternoon he published a newsletter with the headline : “I’m a DeepSeek AI Bro Now. ”

In spite of that observation, the market didn’t budge and Bloomberg wouldn’t write another article with DeepSeek in the headline for five days. And neither did the Wall Street Journal or many others.

The New York Times, to its credit, published a piece on Jan 23rd.

Meanwhile, the debate continued on X.

What’s notable in hindsight is that by that point virtually all the “angles” were explored. How much did DeepSeek really spend? Who built it? How was it done?

There were deep dives by many of the most knowledgeable AI experts.

And yet, the market opened and closed on Thursday and Friday without much ado.

By Sunday, the tide on X had changed. There was widespread expectation Nvidia was going to get crushed in the morning.

On Monday, with major media weighing in to accelerate the negative sentiment, Nvidia lost almost $600 billion in market value, the largest loss by a company in a single day in history.

When history is written, there may emerge Stan Druckenmiller-types who broke the bank on this trade.

But as of now, it’s more notably for how long it took so many to react.