The View from the Office.

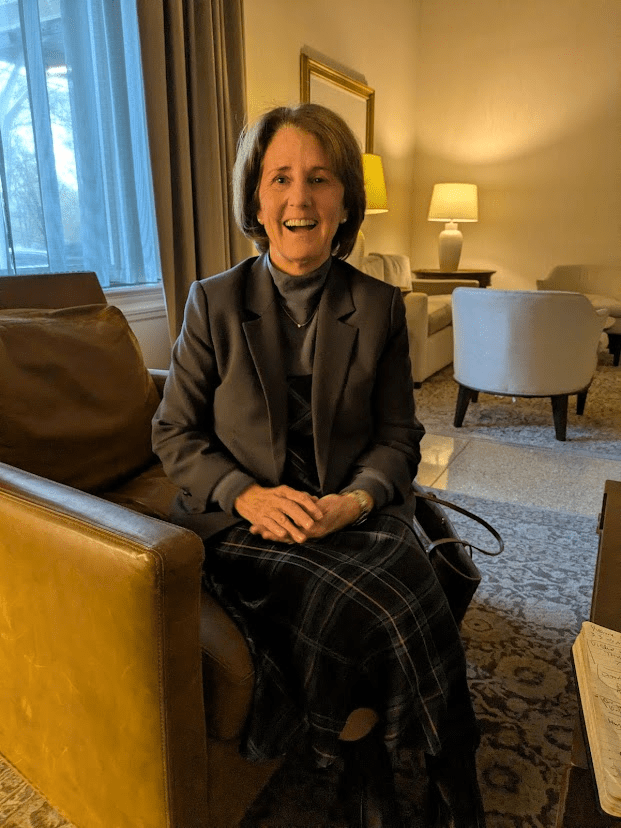

I met up with Christine Jones who co-founded Blue Highway Capital, a private equity fund focused on rural investments, at the New York Athletic Club on 59th Street.

Christine was in town for a board meeting and we got coffee and sat in the lounge beside the iconic lobby. We couldn’t wander any deeper into the building because I was wearing sneakers and that violated the dress code. I love New York!

Blue Highway, which is based in Philadelphia and was co-founded by Karin Gregory, derives its name from the backroads on traditional maps and atlases, which were drawn in blue.

The case for focusing on rural areas is simple: they are badly underserved.

Christine said 85% of venture capital available for private investments in America comes from three states: California, New York, and Massachusetts.

Most of that money gets reinvested back in those same areas. That concentration limits what’s available for other rural opportunities.

Blue Highway currently operates a $100 million growth equity fund. The firm provides capital through subordinated debt and preferred equity with 85% of their deals sourced from proprietary relationships.

They currently invest in industries including specialty manufacturing, natural consumer products and business services.

They want to partner with people who “know their business.” They aren’t looking to run the companies.

While not explicitly an impact fund, Blue Highway Capital measures job creation and community prosperity alongside financial returns.

Christine is looking to connect with more LPs and companies looking for funding.

You can reach her directly on LinkedIn or DM me for a warm intro.