Hedge funds provide their investors regular performance updates.

Back in the 1990s, those hedge fund letters were treated like state secrets. Journalists would try to persuade the investors to leak a copy to break news.

Fast forward to today and we are in a new world.

More and more hedge funds post their investor letters online. It’s part of a general shift toward transparency combined with an awareness that such visibility can help marketing.

Pershing Square, Third Point and Greenlight Capital are some of the larger firms that have at times released letters. Smaller firms often post them more frequently.

The transition from data scarcity to abundance has created new opportunities and challenges.

Where once it was hard to procure information, what’s needed now is help in collecting, sorting and making content accessible. That’s the key to unlocking insights.

At Pricing Culture, the startup I co-founded with Bhargav Shivarthy, we experimented recently by building a news feed made up of AI generated summaries from hedge fund letters that are posted publicly.

We scraped scores of hedge fund sites to collect their letters and then summarized them into standardized formats that provided key details investors would want.

It’s an interesting project because it illustrates a larger truth about the new world of large language models that has emerged in the past two years, namely that LLMs become much more valuable when applied to specific, curated sets of content.

A general ChatGPT request to provide insights from hedge fund letters generates too much random conclusions peppered with hallucinations.

But, if we curate the content, the insights improve considerably.

It’s a reality that we believe will cause companies that want to leverage LLMs to increasingly focus on building gated communities of content.

Check out the feed of hedge fund letters at our site (link in comments.)

We included in the set the “letters” written by Howard Marks, co-founder of Oaktree Capital.

Strictly speaking, Marks’ letters aren’t performance updates. Instead, they are periodic essays about general market conditions and his investment philosophy.

They have, however, become so popular it made sense to include them.

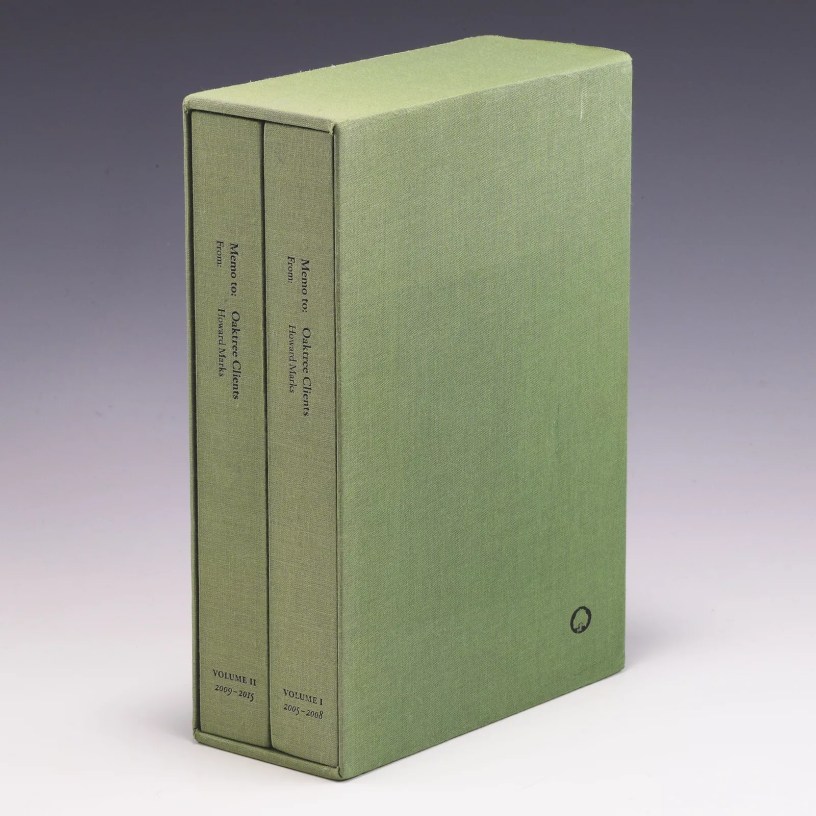

One gauge of how valuable people think Marks’ letters are can be found by going on eBay. There you’ll find a two-volume set of his collected memos from 2005 to 2015 for $600.

Reach out if you want to learn more about our efforts to turn numbers into narratives, thereby unlocking other investment insights.